Cultivating a trusted and dependable marketplace, Arthentico is dedicated to delivering precise and knowledgeable appraisals of art's intrinsic worth. This is accomplished through the harmonious integration of data analysis, expert viewpoints, and historical data, resulting in the development of a comprehensive valuation framework that inspires unshakable market confidence.

Why invest in art?

Enhance the performance of your traditional stock and bond portfolio by allocating to art

(compared to S & P 500)

Yahoo Finance provides an insightful perspective on art investment through their Artprice100© index. They state:

'As a sales-based indicator, our Artprice100© index reflects a purely financial approach to art that in no way replaces the non-financial relationships between art collectors and artists. In essence, our index reveals the hypothetical financial result you would obtain if you were to invest in the world's top-selling artists to benefit financially from their success.'

This perspective emphasizes the financial dimension of art investment while acknowledging the intrinsic, non-financial connections that form the essence of art collection.

In 2022, amidst global challenges like the ongoing COVID-19 pandemic and the Ukraine war's economic impacts, the global art auction market flourished, marking one of its best years. Despite a 19% drop in the S&P 500 and a downturn in cryptocurrencies affecting NFT transactions, American auction houses recorded record sales, particularly in paintings, photography, and tapestry. This buoyancy was echoed in France, Germany, and Hong Kong, stabilizing the global art market. Key trends included intense competition for masterpieces from renowned collections like Hubert de Givenchy and Paul G. Allen, and a growing interest in Ultra-Contemporary Art by very young artists, as highlighted in Artprice's Annual Report.

Benefits of allocating money in Contemporary Art

(based on scientific evidence)

Market Dynamism

The latest insights from Art Basel indicate a notable trend shift among art collectors. The current data reveals that, on average, 39% of collectors are now engaging in the resale of their acquired artworks within a three-year period, a considerable escalation from the previously recorded 30% in 2021. Additionally, it is quite significant to observe that a dominant proportion of collectors, representing 83%, opt to resell their artworks within a five-year timeframe, marking a substantial rise from the 73% noted in the year prior.

Physical well being

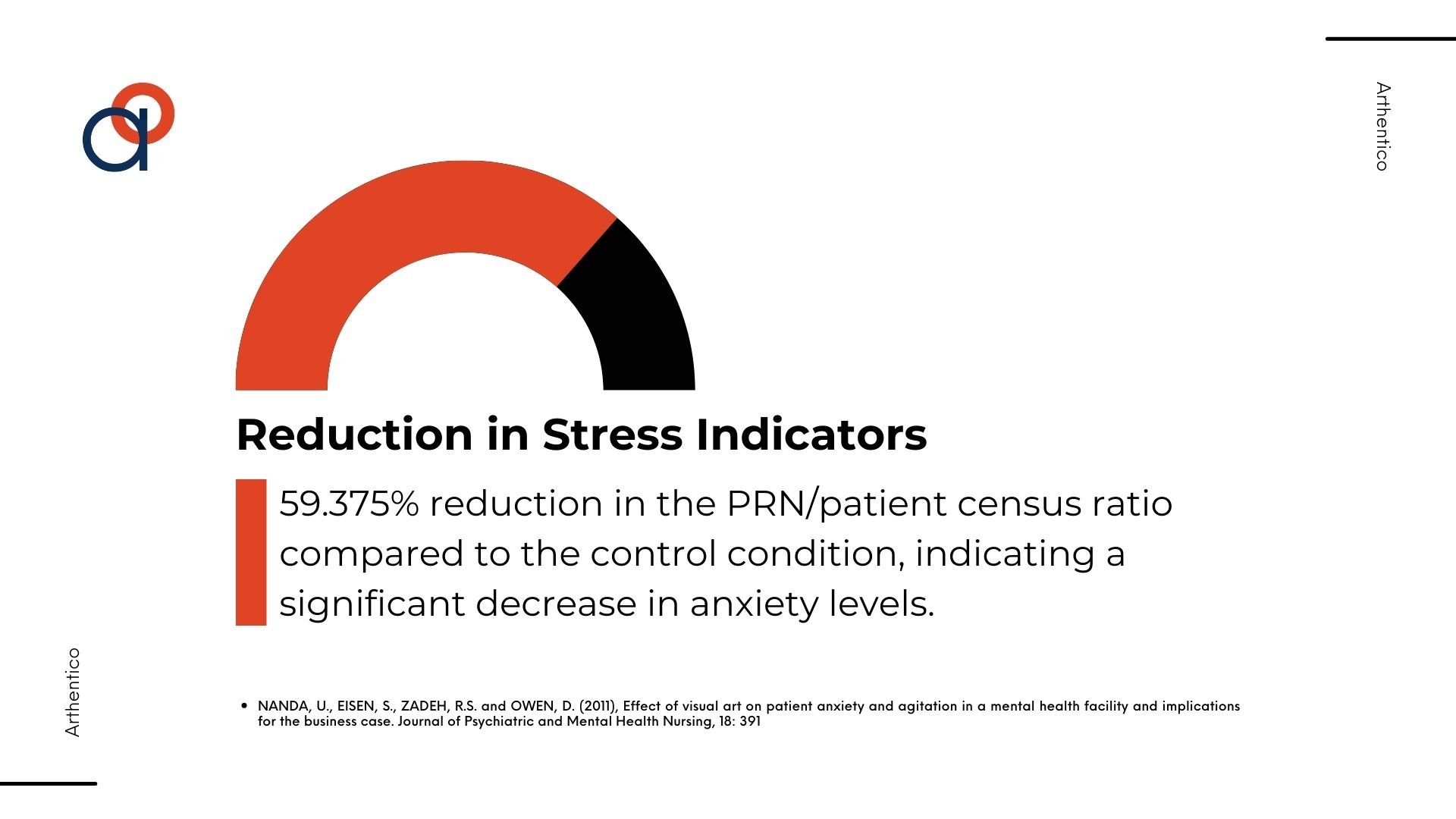

Studies (Rollins et al. 2009, Ulrich 2009) show that art in acute-stress settings leads to better clinical outcomes, including lower heart rate, blood pressure, and reduced pain perception. The presence of art, has been linked to faster recovery times and improved patient experiences in hospitals (Ulrich et al. 2004). The improvement in patient experiences due to art, including aspects like privacy, dignity, and identity, can be extrapolated to non-healthcare settings. Art can enhance the quality of an environment, making it more aesthetically pleasing and psychologically comforting, which is beneficial for anyone's mental and emotional health.

How value in art is calculated

(We simplify the intricacies of the art market, where artwork prices are influenced by a multitude of factors, making it accessible to you)

Supply and demand:

The reputation and notoriety of the artist play a crucial role. Artists with an established career and a history of successful exhibitions and auctions tend to achieve higher prices for their works. Collectors and galleries then also like to go for names that are already known, as they assume that the works of these artists will increase in value.

Nevertheless, this does not mean that a young artist cannot also be very successful. Galleries and artistic institutions often have a great influence on how artworks are perceived and can significantly increase demand, because the basic principle of supply and demand also applies in the art market. If there are many people who want a certain artwork (high demand) and there are only a small number of works by a certain artist with that particular style (low supply), the price usually goes up. Conversely, if there is little interest and there are many similar works on the market, prices fall.

Art market cycles:

Prices for artworks can also be influenced by art market cycles, as there are also simply always times when prices for artworks rise and times when they fall. These cycles can be influenced by various factors, such as economic conditions, trends in the art world and the buying behaviour of collectors.

Originality and type of the artwork:

Unique artworks with a compelling backstory tend to fetch higher prices because they are fundamentally harder to replace. If a work has an interesting story, addresses an important topic or exudes a particularly novel aesthetic, it may be more valuable. Large paintings or sculptures, for example, also often fetch higher prices than smaller ones. Certain media, such as oil paintings or sculptures, can tend to cost more than drawings or prints, for example. The opinions of art experts and critics also play a major role here, as positive reviews or recommendations from experts can increase collectors' interest.

FAQs

-

At Arthentico, we always focus on quality over quantity. Our admissions process is highly selective and our art historian works closely with us to choose talented artists. If you would like to learn more about our selection process, you can find detailed information here: (Link)

-

The number of new artists can vary from month to month, but on average we introduce about five new artists per month. However, it is very important to us that the quality of our selection is always maintained. Therefore, we only include artists who meet our strict quality criteria.

-

On our website, right at the top of the homepage, you will find a list of three artists whose works have increased in value the most since they joined our platform.

-

The artworks are shipped directly from the artist to you. The delivery time varies depending on where the artwork is received. In Europe, it usually takes about one week for your work to reach you after it has been sent. In countries outside Europe it may take a little longer. When you check out, you will be informed about your possible shipping options.

-

At Arthentico we work closely with our artists and in many cases know them personally. When you purchase a work through Arthentico, you will receive a certificate personally signed by the artist, which will be sent to you together with the artwork. This guarantees the authenticity of the artwork.

-

Within one working day of purchase, we will email you a document with recommendations on how to care for the artwork. In addition to the delivery, you will also receive printed instructions to help you keep the work in perfect condition.

-

Since August 2023, we have made it possible for you to resell works you have already purchased from us on our platform via "Arthentico Infinity Home". Here you can find detailed instructions on how our resell process works: (Link)

-

Getting started in art investing is exciting, but there are risks involved. At Arthentico, we always monitor current trends and offer investment strategies to help you. If you are interested in investing in art, we have set up a special section on our website that provides comprehensive information and advice on the subject:(Link)

-

As soon as an artist's work that you have invested in increases in price, you will be notified both by email and in your personal account (portfolio) about the increase in value.